A Guide to Donating (Money) To A New-To-You Nonprofit

by Kaylee Tock

NOTE: Guide Kaylee Tock led readers & runners on a four-mile Running Tour in September 2024 inspired by the work of Jane, an underground abortion counseling service that functioned in Chicago from 1969-1973. At the end of our route, Kaylee shared contemporary resources for those looking to stay active in reproductive health advocacy. Kaylee wrote this blog to help guide readers & runners through the vetting of new-to-them nonprofits.

Kaylee guiding the September 2024 Running Tour of the Jane Collective.

First, decide what matters to YOU.

You might want to help fund procedures for those who can’t otherwise afford them; your friend might want to ensure education opportunities are more widely available; your other friend might want to support contraceptive access in underserved areas.

Then, take a look at the organization’s language.

Do they strive for inclusivity? Are they centering their narrative around those directly impacted? Are they clearly stating their mission and how they achieve that through their work?

Extra credit: glance at their financials to see where your money will actually go

Pro Tip: You’ll need only about five minutes once you know what to look for!)

Many organizations (but not all!) post their financials on their site as part of an annual impact report. If they’re doing this, they can also explain (or spin?) any weird numbers.

Do your own research with the annual tax filings (the 990)!

What to look for: functional expenses (part IX, usually around page 10 - just search the term) - aka, what is the percentage they are spending on programming, fundraising, and admin? Look for at least 75% in programming – that’s literally where they’re tracking their work/impact.

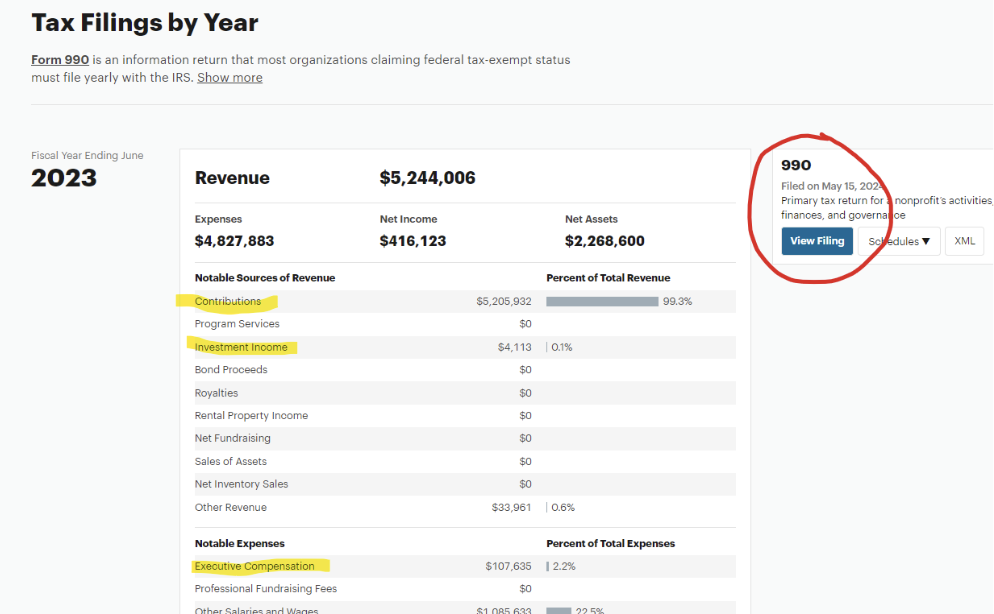

ProPublica is a fantastic resource that doesn’t make you register to use it. Their dashboard highlights:

the top level revenue so you can see if they’re getting donations only, or also have some sort of earned funding - aka, maybe they do in-house education for other organizations as an additional revenue stream

the Executive salaries so you know that they aren’t overpaying their director(s)

graphs illustrating changes over the years

And it offers a super easy-to-search view of the 990.

(Guidestar will force you to create a free profile if you want to look at details, and their 990 search is far less user-friendly. Many nonprofits report directly with them because they can get a rating for “transparency”, though, so some profiles might have more recent filings available.)

Here’s a quick example using the Chicago Abortion Fund’s ProPublica page:

On the landing page, we have our historical data:

Tip: don’t worry if revenue is more than expenses; that can mean they have a lot of funding promised but NOT received yet, or that they have a strategic plan to build a reserve fund.

Scrolling down, we can see that over 99% of their revenue is from donations. That means they aren’t offering any fee-for-service programming, nor did they have a fundraising gala during the year (two very common things for nonprofits). They also have VERY little funding sitting in interest-bearing accounts.

Below, we can see their Exec Compensation is a modest $107k.

Last step: click on the 990: View Filing - then find text “functional expenses”

This is where we can get into the details of the total $4.8M expenses during the year…. Or we can just look at the highlights (column names highlighted for viewability) and the quick big-pic view – the next instance of “Functional Expenses” at the bottom of this page will show you the totals:

In this case, Chicago Abortion Fund is spending 89% of their full expenses on programming - meaning your donation to them is very likely making a direct impact on people’s lives. 🎉

Additionally, in CAF’s case, line 2 - “Grants and other assistance” - for $3 million is literally what they gave to 9000 recipients for abortion services through the year. This is detailed in Schedule I:

(Most orgs do not give monetary assistance, so this kind of 990 transparency is a bit of a unicorn)

Now you’re a pro and can feel confident about donating your dollars!

A note on 501(c)(4)’s - these are the nonprofits that can directly engage in politics, and be specific about it – as such, donations to them are NOT tax-deductible. National orgs like Planned Parenthood and Reproductive Freedom for All (fka NARAL) have c4 arms, where they don’t have to worry about lobbying limits their c3 counterparts do. Other c4 orgs, like NOW (National Organization for Women), have c3 branches to help further their programmatic reach.